top of page

WHITNAH CPA

CALL US: 678-780-8615

Your One-Stop Solution for CPA Services, Tax & Accounting,

Health, Life, Annuities, Property and Casualty Insurance —

All in One Place!

Search

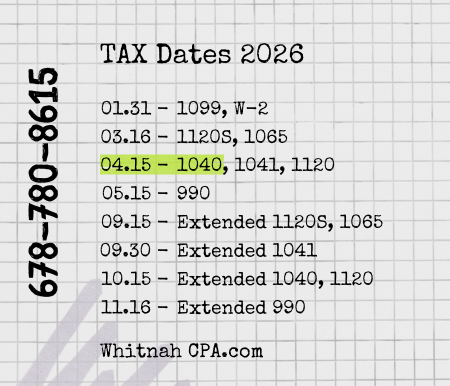

Important Tax Deadlines 2026

Individual Income Tax Return (Form 1040) Filing Deadline: April 15, 2026. Extended filing deadline (file extension using Form 4868): October 15, 2026. The FBAR (FinCEN Form 114) filing deadline coincides with the federal income tax return due date. An automatic 6-month extension is allowed, generally until October 15. Partnerships (Form 1065): March 16, 2026 (extended deadline: September 15, 2026), or the 15th day of the third month after the end of the partnership

Iryna Whitnah

Dec 23, 20252 min read

2025 Tax Rates for Individuals: Ordinary Income, Capital Gains, and Standard Deductions Under the New Law

2025 Tax Rates for Individuals: Ordinary Income, Capital Gains, and Standard Deductions

Iryna Whitnah

Nov 24, 20252 min read

HSA Health Savings Accounts (HSA) & Health Insurance in 2026: What You Need to Know

As healthcare costs continue to rise, using a Health Savings Account (HSA) paired with a High-Deductible Health Plan (HDHP) is becoming an increasingly popular strategy for managing expenses and saving for the future. A Health Savings Account (HSA) is a tax-advantaged savings account that allows you to set aside money to pay for qualified medical expenses federal-tax free, provided you are covered by an HSA-eligible high-deductible health plan (HDHP). The major advantages a

Iryna Whitnah

Nov 7, 20254 min read

Charitable Donations: OBBBA 2026 Changes to Deduction Rules

Charitable Gifts: 2025 may be the best year to make large charitable gifts before the new restrictions take effect. New rules from the One Big Beautiful Bill Act will change how charitable contributions are deducted starting in 2026, affecting both itemizers and nonitemizers.

Iryna Whitnah

Nov 5, 20254 min read

Iryna Whitnah

Nov 5, 20250 min read

New Senior Deduction: Tax Relief for Older Americans

Beginning in 2025, a new Senior Deduction will provide extra tax relief for older taxpayers. This deduction was introduced under the One...

Iryna Whitnah

Oct 7, 20251 min read

The One Big Beautiful Bill: How Overtime Pay Is Changing

The One Big Beautiful Bill: How Overtime Pay Is Changing

Iryna Whitnah

Oct 2, 20252 min read

Welcome to Whitnah CPA!

We bring together a rare combination of expertise—as Public Accountants, Tax Professionals, and Licensed Insurance Agents—all in one place. With these diverse credentials, we don’t just prepare taxes or crunch the numbers. We help individuals, families, and businesses see the bigger financial picture, manage risks, and create strategies to protect and grow their wealth. Instead of working with multiple professionals for taxes, compliance, and insurance.

Iryna Whitnah

Sep 19, 20250 min read

Why I Sometimes Say “No” – Losing Clients by Doing the Right Thing

As a CPA, my role is more than just preparing tax returns or crunching numbers. It’s about protecting my clients’ financial well-being...

Iryna Whitnah

Sep 4, 20253 min read

Estimated Taxes for Individuals and Businesses

This article will help to understand the concept of estimated tax payment and covers who must pay, how much to pay, due dates,...

Iryna Whitnah

Aug 25, 20253 min read

One Big Beautiful Bill: Update on the Newly Signed Tax Legislation

In a sweeping move set to reshape the U.S. tax landscape for years to come, the “One Big Beautiful Bill” has officially been signed into...

Iryna Whitnah

Jul 15, 20253 min read

Workers’ Compensation for Contractors.

Workers’ compensation is a critical component of business compliance when hiring employees or working with contractors. Requirements vary...

Iryna Whitnah

Jun 18, 20252 min read

The One Big Beautiful Bill Act, June 2025.

In May 2025, the U.S. House of Representatives narrowly passed a budget resolution, “The One, Big, Beautiful Bill Act” (OBBB), with vote...

Iryna Whitnah

Jun 13, 20253 min read

Education Savings Simplified: The 529 Plan Advantage.

A 529 Plan, often called a college savings pla n , is a tax-advantaged account designed to help families save for education expenses....

Iryna Whitnah

May 29, 20253 min read

Did You Know That You Can Save on Taxes for Your Kids' Summer Camps?

As summer approaches, many parents begin planning for their children’s summer activities. While summer camps offer invaluable...

Iryna Whitnah

May 23, 20253 min read

Where Do You Keep Your Emergency Fund: Dollars, Stocks, or Gold? How Much Should You Save?

When it comes to financial security, having a well-structured emergency fund is critical. But beyond the basic question of how much you...

Iryna Whitnah

May 9, 20254 min read

How to Prepare for a Financial Review or Audit: A Practical Guide for Business Owners

Preparing for a financial review or audit doesn't have to be stressful. With the right strategy and preparation, your business can...

Iryna Whitnah

May 2, 20253 min read

Major IRS Tax Updates for 2025: What You Need to Know

As we move further into 2025, the IRS has announced several important updates that will affect taxpayers of all income levels. From...

Iryna Whitnah

May 2, 20252 min read

Key Tax Proposals Under Project 2025

As President Donald Trump embarks on his second term, his administration is advancing a series of tax policy initiatives that could...

Iryna Whitnah

Apr 22, 20252 min read

When Do I Need to Amend My Tax Return — and What Does It Mean?

Filing a tax return isn’t always the final step. Sometimes, life changes or honest mistakes require you to amend your return. But what...

Iryna Whitnah

Apr 13, 20252 min read

bottom of page