Tax Preparation

- Iryna Whitnah

- Feb 26, 2024

- 3 min read

Tax season is here! This tax season we accept walk-in clients in our office each Saturday starting from January 20 till April 6, from 10 am to 5 pm. We accept remote clients all the time.

Fixed Fee with Guarantees!

We offer personal approach, quality service, no hidden commissions,

We will have your 2023 individual tax return ready withing 3 day or sooner,

We will provide free phone calls for all 2024,

We will return your call within 24 hours,

We will provide electronic filing,

We will provide newsletters for tax matters,

We are responsible for penalties related to our preparation error,

We support resolving any post filing questions with the IRS for all 2024,

We assure CPA diligent service.

Address: 500 Sun Valley Dr, Suite A3, Roswell, GA 30076

Phone: 678-780-8615

Tax preparation involves the process of organizing and filing your financial information with the relevant tax authorities to comply with tax laws. Here are some key steps and considerations for tax preparation:

Gather Documents:

Collect all relevant financial documents, such as W-2s, 1099s, receipts, and any other records related to income, deductions, and credits.

If you're self-employed or a business owner, gather business-related documents like profit and loss statements, business expenses, and receipts.

Understand Your Filing Status:

Your filing status (single, married filing jointly, head of household, etc.) affects your tax rates and deductions. Choose the status that best fits your situation.

Choose a Tax Form:

The form you use depends on your financial situation. Common forms include 1040, 1040A, and 1040EZ. More complex situations may require additional forms and schedules.

Review Changes in Tax Laws:

Stay informed about any changes in tax laws that may impact your filing. Tax laws can change annually, and staying updated helps ensure accurate and compliant filing.

Consider Deductions and Credits:

Identify eligible deductions and credits to minimize your tax liability. Common deductions include mortgage interest, student loan interest, and medical expenses. Credits may include the Child Tax Credit or Earned Income Tax Credit.

Hire a Professional:

Tax software simplifies the process for many individuals. It guides you through the necessary steps and calculations. Alternatively, hiring a tax professional can provide personalized advice and ensure accuracy. Certified public accountants (CPAs), enrolled agents, and other tax professionals offer in-person tax preparation services. They can provide personalized advice, answer tax-related questions, and ensure that your return is accurate and compliant with current tax laws.

Check for Errors:

Review your completed tax return for errors before submission. Common mistakes include typos, incorrect Social Security numbers, and mathematical errors.

File on Time:

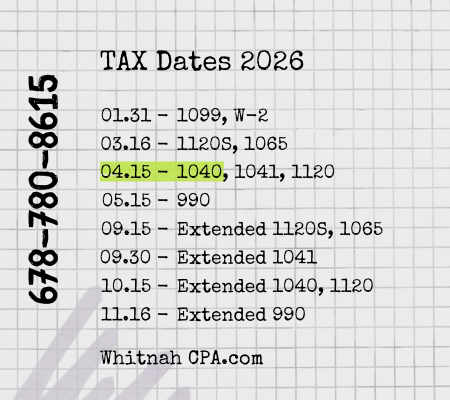

Make sure to file your tax return by the deadline. The deadline is typically April 15th, but it can vary. Filing late may result in penalties and interest.

Consider Electronic Filing:

Electronic filing (e-filing) is a secure and efficient way to submit your tax return. It can also expedite the processing of your refund if you're eligible for one.

Keep Records:

Retain copies of your filed tax returns and supporting documents for several years. This can be important for future references or in the event of an audit.

Remember that tax laws can be complex, and individual situations vary. It's often beneficial to seek advice from a tax professional, especially if you have a more complex financial situation or if you're unsure about specific tax implications.

When choosing a tax preparation service, consider the complexity of your financial situation, your comfort level with technology, and your budget. Additionally, make sure to provide accurate and complete information to ensure the proper filing of your tax return. If you have specific questions or concerns, seeking advice from a certified tax professional is often a prudent approach.

Income Tax Preparation has never been easier—thanks to GTA Accounting for their professional and reliable service!