top of page

WHITNAH CPA

CALL US: 678-780-8615

Your One-Stop Solution for CPA Services, Tax & Accounting,

Health, Life, Annuities, Property and Casualty Insurance —

All in One Place!

Search

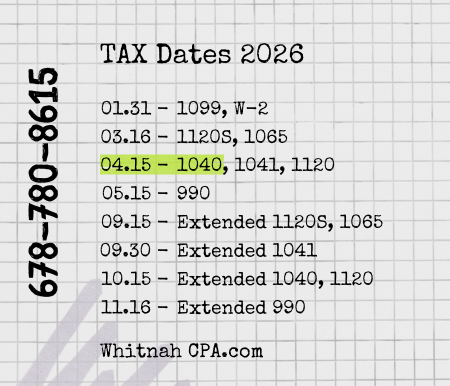

Important Tax Deadlines 2026

Individual Income Tax Return (Form 1040) Filing Deadline: April 15, 2026. Extended filing deadline (file extension using Form 4868): October 15, 2026. The FBAR (FinCEN Form 114) filing deadline coincides with the federal income tax return due date. An automatic 6-month extension is allowed, generally until October 15. Partnerships (Form 1065): March 16, 2026 (extended deadline: September 15, 2026), or the 15th day of the third month after the end of the partnership

Iryna Whitnah

Dec 23, 20252 min read

2025 Tax Rates for Individuals: Ordinary Income, Capital Gains, and Standard Deductions Under the New Law

2025 Tax Rates for Individuals: Ordinary Income, Capital Gains, and Standard Deductions

Iryna Whitnah

Nov 24, 20252 min read

Charitable Donations: OBBBA 2026 Changes to Deduction Rules

Charitable Gifts: 2025 may be the best year to make large charitable gifts before the new restrictions take effect. New rules from the One Big Beautiful Bill Act will change how charitable contributions are deducted starting in 2026, affecting both itemizers and nonitemizers.

Iryna Whitnah

Nov 5, 20254 min read

Iryna Whitnah

Nov 5, 20250 min read

The One Big Beautiful Bill: How Overtime Pay Is Changing

The One Big Beautiful Bill: How Overtime Pay Is Changing

Iryna Whitnah

Oct 2, 20252 min read

bottom of page