top of page

WHITNAH CPA

CALL US: 678-780-8615

Your One-Stop Solution for CPA Services, Tax & Accounting,

Health, Life, Annuities, Property and Casualty Insurance —

All in One Place!

Search

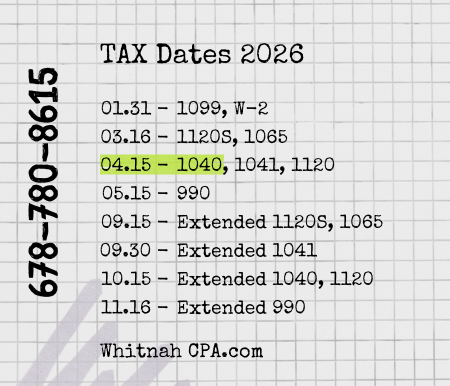

Important Tax Deadlines 2026

Individual Income Tax Return (Form 1040) Filing Deadline: April 15, 2026. Extended filing deadline (file extension using Form 4868): October 15, 2026. The FBAR (FinCEN Form 114) filing deadline coincides with the federal income tax return due date. An automatic 6-month extension is allowed, generally until October 15. Partnerships (Form 1065): March 16, 2026 (extended deadline: September 15, 2026), or the 15th day of the third month after the end of the partnership

Iryna Whitnah

Dec 23, 20252 min read

Iryna Whitnah

Nov 5, 20250 min read

Estimated Taxes for Individuals and Businesses

This article will help to understand the concept of estimated tax payment and covers who must pay, how much to pay, due dates,...

Iryna Whitnah

Aug 25, 20253 min read

IRS Certified Acceptance Agent (CAA) - ITIN application

You might need an IRS Certified Acceptance Agent (CAA) for several reasons: 1. Expertise: CAAs are trained and certified by the IRS,...

Iryna Whitnah

Jun 6, 20241 min read

Financial Due Diligence

Assessment of the financial health and performance of a target company during mergers and acquisitions (M&A), investments, or other...

Iryna Whitnah

Feb 26, 20242 min read

bottom of page