When Do You Need to File Form 1099?

- Iryna Whitnah

- Dec 22, 2022

- 2 min read

Updated: May 4, 2023

The IRS 1099 Form is a tax form documenting different types of payments made by an individual or a business that typically isn’t your employer. The payer fills out the form and sends copies to you and the IRS, reporting payments made during the tax year. A copy must also be sent to your state taxing authority. The payer is responsible for filling out the appropriate 1099 tax form and sending it to you. Such payments can be for rental income, earnings working as a freelancer or independent contractor, and more. Most 1099 forms are required to be provided by January 31, but in certain instances, this date is February 15. You will be requested to complete the W9 form to provide payer with the information such as your name, address, and tax numbers.

Some common examples when you need to file a 1099 include:

If you pay $600 or more in nonemployee compensation to a person or business who isn’t typically your employee, you should issue a Form 1099-NEC

If you pay $600 or more in rent or royalty payments, you should issue Form 1099-MISC

Form 1099-NEC, which is typically used to report payments to you if you're an independent contractor or freelancer, is due to you by January 31st. If January 31st isn't a business day, then the due date moves to the next business day.

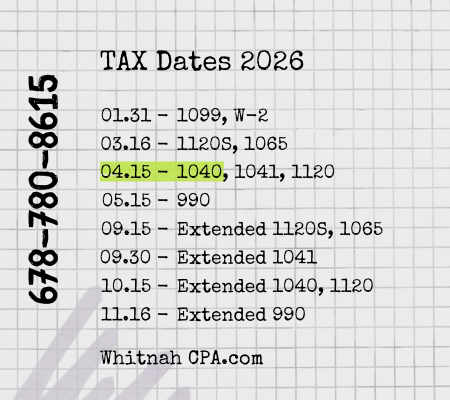

The common due dates for 1099 forms:

Most 1099 forms are due to the recipient by January 31st.

If you’re mailing a paper form to the IRS, you typically must send the 1099 by February 28 (postmarked by that date).

Forms 1099-NEC are due to recipients and to the IRS by January 31 regardless of whether they are electronically, or paper filed.

Form 1099-NEC reports nonemployee compensation but the 1099-MISC exists to report other types of miscellaneous income.

Reach out to us at 678-780-8615 if you need any help to file the forms or need any help to understand if you are required to file this form.

Comments